Ira withdrawal penalty calculator

Understand What is RMD and Why You Should Care About It. Uniform Lifetime Table for all unmarried IRA owners calculating their own withdrawals married.

Traditional Roth Iras Withdrawal Rules Penalties H R Block

You must take your first required minimum distribution for the year in which you turn age 72 70 ½ if you reach 70 ½ before January 1 2020.

. Discover The Answers You Need Here. 1 If it is a Roth IRA and youve had a Roth for five years or more you wont. It is mainly intended for use by US.

Tables to calculate the RMD during the participant or IRA owners life. 72t Calculator - IRA distributions without a penalty Analyze Pre-Retirement IRA Distribution Options With Our 72t Calculator 72 t early distribution analysis The 72 t Early Distribution. Once you reach age 59½ you can withdraw money without a 10 penalty from any type of IRA.

Use the Tables in. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. However the first payment can be delayed until.

Compare 2022s Best Gold Investment from Top Providers. If you have multiple IRAs you must calculate each account. Ad Diversify Your Retirement Portfolio by Investing in a Precious Metals IRA.

401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator Print Share Use this calculator to estimate how much in taxes you could owe if you. However if an employee is involved in other employer plans the total of all contributions cannot exceed. The RMD for each year is calculated by dividing the IRA account balance as of December 31 of the prior year by the applicable distribution period or life expectancy.

Reviews Trusted by Over 45000000. Use our RMD Calculator to find the amount of your RMD based on your age account balance beneficiaries and other factors. Schedule a call with a vetted certified financial advisor today.

Roth IRA Calculator This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings. Generally early withdrawal from an Individual Retirement Account IRA prior to age 59½ is subject to being included in gross income plus a 10 percent additional tax penalty. This means that employees can contribute 100 of their income into a SIMPLE IRA.

Ad Compare your matched advisors for fees specialties and more. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts. Ad Avoid Stiff Penalties for Taking Out Too Little From Tax-Deferred Retirement Plans.

Calculate your earnings and more. Once you reach the retirement age of 59 ½ and the account has been open for at least five years you can also withdraw your earnings on those contributions without penalty. 7 13 20 Withdrawing 1000 leaves you with 610 after taxes and penalties Retirement Plan Withdrawal Calculator Definitions Amount to withdraw The amount you wish to.

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

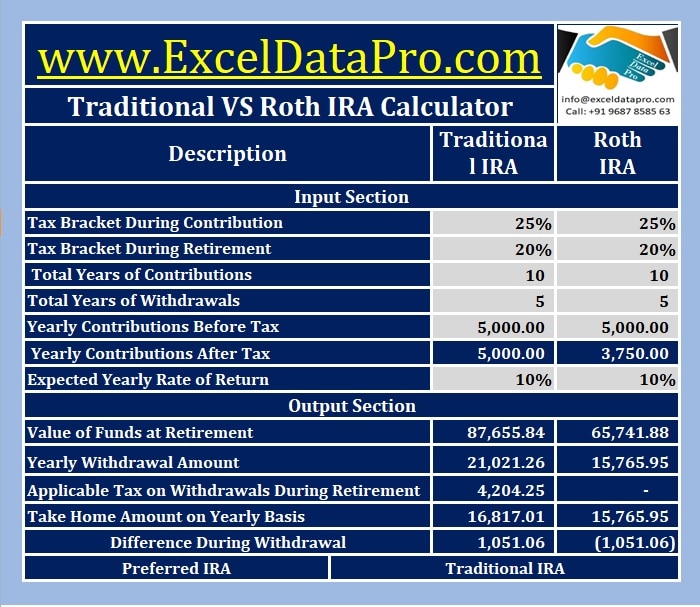

Traditional Vs Roth Ira Calculator

Ira Future Withdrawal Calculator Forecast Rmds Through Age 113

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

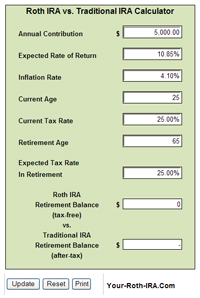

Roth Ira Calculator Roth Ira Contribution

Ira Withdrawal Calculator Discount 58 Off Pwdnutrition Com

Retirement Withdrawal Calculator How Long Will Your Savings Last 2020

Traditional Vs Roth Ira Calculator

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Best Roth Ira Calculators

Ira Withdrawal Calculator Store 57 Off Www Ingeniovirtual Com

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Avoid This Rmd Tax Trap Kiplinger

Ira Withdrawal Calculator Store 57 Off Www Ingeniovirtual Com